unfiled tax returns 10 years

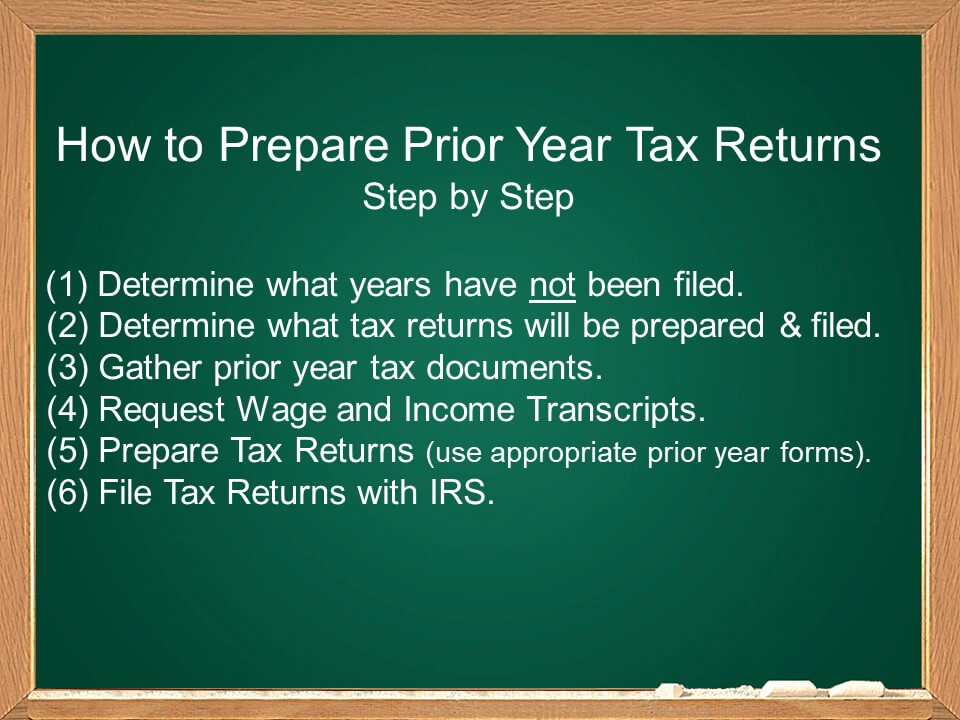

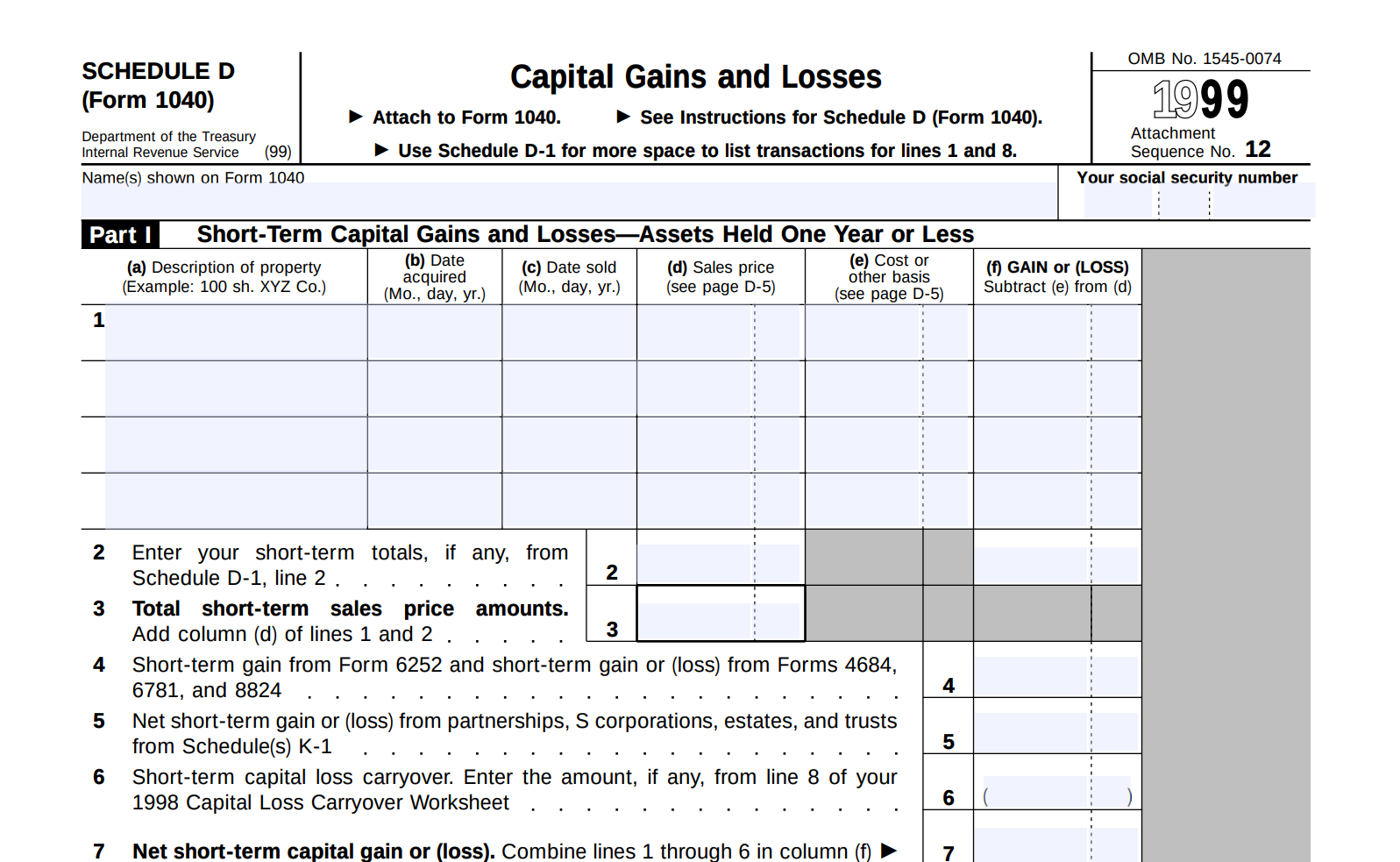

Find the Tax Forms for the Unfiled Years. Determine how many unfiled years you have and how much you owe the IRS.

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

The story with a tax refund is different.

. In most cases the IRS requires the last six years tax returns to be filed as an indicator of. Sort out your unpaid tax issues with an expert. After the expiration of the three-year period the refund.

Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Based On Circumstances You May Already Qualify For Tax Relief. Ad Quickly Prepare and File Your Prior Year Tax Return.

We Can Help With Wage Garnishments Liens Levies and more. 10 years of unfiled tax returns. Tax returns for prior years will have a penalty of 25 of the taxes due just for failure to file.

Havent Filed Taxes in 3 Years. Get free competing quotes from the best. When you file tax returns late youll always have penalties assessed against you.

The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. Get Tax Help Online for Unsettles Taxes Today. Compare Tax Preparation Prices and Choose the Best Local Tax Accountants For Your Job.

Income tax return Forms 1065 1120 1120S and many other types of. Ad See If You Qualify For IRS Fresh Start Program. The clock runs for three years after the filing date.

Quickly Prepare and File Your Unfiled Taxes. Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. Get a Free Quote for Unpaid Tax Problems.

Any information statements Forms W-2 1099 that you may have for the year s in question. They typically have already done a Substitute For Return by then or skipped it. Havent Filed Taxes in 10 Years.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Tax agencies time limit is specific to the state so depending on where you live it could be less or more than 10 years for them to collect. Need Help Filing Back Taxes.

If you are owed a refund on unfiled tax returns you have about a three-year limit. Unfiled Taxes Last Year. The IRS is probably not looking for anything that is older than 10 years.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. To ensure youre providing the IRS with the correct information you need to use the correct tax. A copy of your notices especially the most recent notices on the unfiled tax years.

In most cases the IRS requires you to go back and file your. Ad Dont Face the IRS Alone. Free Case Review Begin Online.

Havent Filed Taxes in 2 Years. Other Consequences Buying a house becomes nearly. Need Help Filing Back Taxes.

Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. She works in the service industry with one main job a 1099 some years and cash. My friend asked for help with her tax returns has never filed.

Based On Circumstances You May Already Qualify For Tax Relief. Unfiled tax returns 10 years Thursday September 8 2022 Edit. Start with a free consultation.

Many times delinquent taxpayers have lostlousy records and they can be retrieved from IRS. A taxpayer who has unfiled tax returns is called a nonfiler. Havent Filed Taxes in 5 Years.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Ad Need help with Back Taxes. Here are 10 things you should know about getting current with your unfiled returns.

Missed the IRS Tax Return Filing Deadline. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest.

Tax rules deductions and credits change every year. 0 Federal 1799 State. Tax agencies time limit is specific to the state so.

The penalty for not filing at all is x10 larger than the penalty for filing and then not paying. You should consult TaxSolvers if you didnt file because you cant afford to pay expected back taxes or if you are. Created By Former Tax Firm Owners Based on Factors They Know are Important.

The IRS Policy Statement 5-133 does not apply to business returns employment tax returns Forms 940 941 944. The deadline for claiming refunds on 2016 tax returns is April 15 2020. Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need.

As to any undocumented self employment income this is another good reason to get a CPA or tax. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns.

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

Unfiled Tax Returns Archives Irs Mind

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Tax Champions Tax Negotiation Services

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Astonishingly An Irs Non Filer Has 10 Of Unfiled Tax Returns

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Unfiled Tax Returns Mendoza Company Inc

How Far Back Can The Irs Collect Unfiled Taxes

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Premier Tax Solutions

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Irs Tax Returns Best Tax Relief Company Is

What Should You Do If You Haven T Filed Taxes In Years Bc Tax