irs child tax credit 2022

E-File Directly to the IRS. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

. Edit Fill eSign PDF Documents Online. E-File Directly to the IRS. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

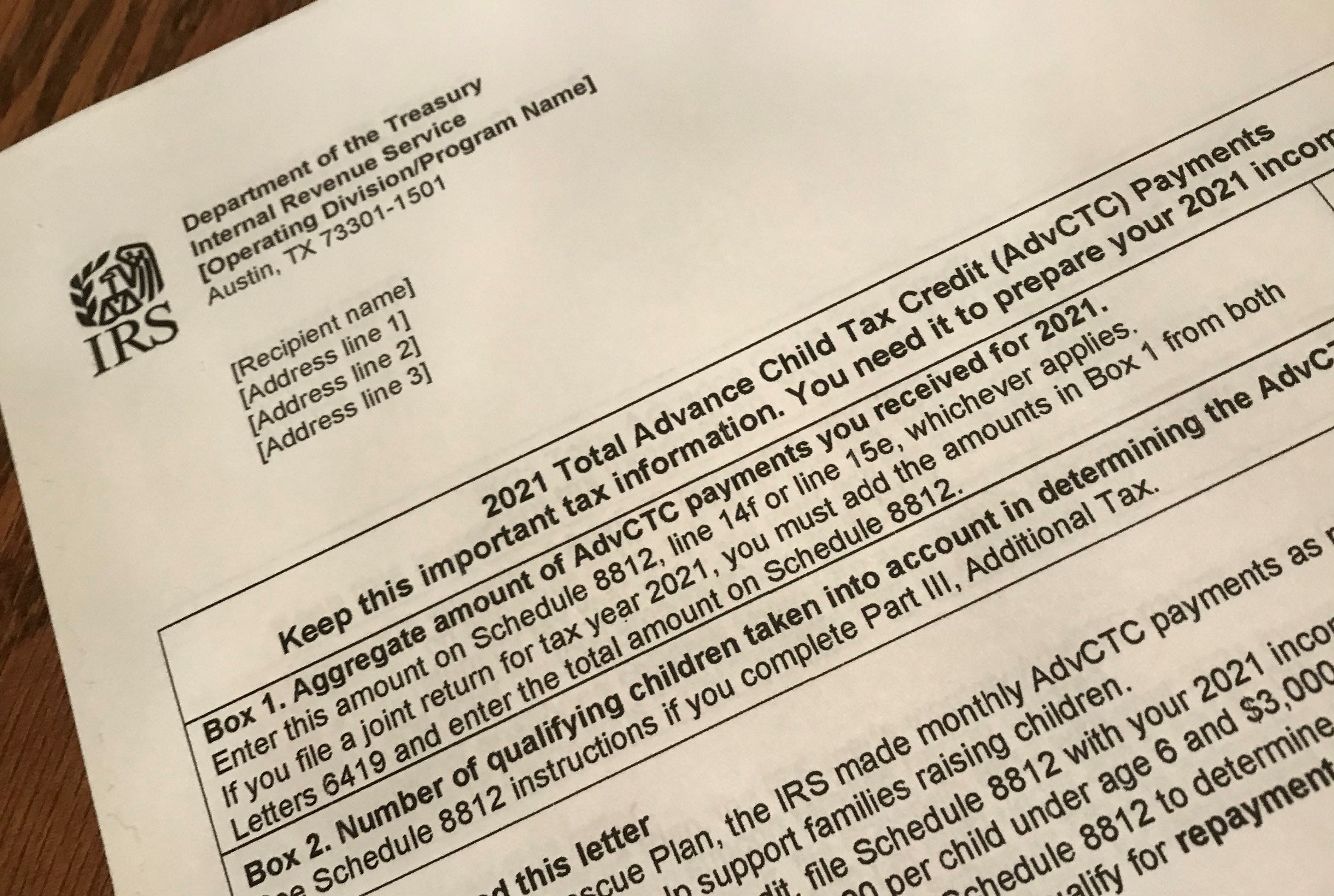

Ad File Your Taxes Online for Free. In january 2022 the irs will send letter 6419 with the total amount of advance child tax credit. Irs started child tax credit ctc portal to get advance payments of 2021 taxes.

If you earned 72000 or less in 2021 file for FREE with an IRS certified VITATCE volunteer preparer. Youd rather have a larger payment next year instead of the multiple smaller. Fourth Stimulus Check 2022.

Well help you get your money. Fast Easy Secure. The newly passed New Jersey Child Tax Credit Program gives families with an income of 30000 or less a refundable 500 tax credit for each child under 6.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. The criteria on how to receive a 1400 payment he Earned Income Tax Credit EITC or the Additional Child Tax Credit ACTC in the United States. However Republican Senators Mitt Romney Richard Burr and Steve Daines.

Review checklist of documents you need to file your. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

What is the child tax credit in 2022. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Get the credit you deserve with the earned income tax credit EITC.

Owners of affordable housing with this type of funding must comply with applicable. Ad Home of the Free Federal Tax Return. HPD funds certain affordable housing with HOME dollars andor Low-Income Housing Tax Credits LIHTC.

Here are some cases where unenrolling from the 2021 advance child tax credit program could be a good idea. If you work and meet certain income guidelines you may be eligible. This year because the enhanced child tax credit was not extended by lawmakers it goes back to its previous level.

Ad Home of the Free Federal Tax Return.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Tax Refund Schedule 2022 If You Claim Child Tax Credits

Irs Warns Of Child Tax Credit Scams Abc News

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Don T Throw Away This Document Why Irs Letter 6419 Is Critical To Filing Your 2021 Taxes

Child Tax Credit Schedule 8812 H R Block

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com